Picture this: Ravi, a small textile manufacturer from Tirupur, was earning just ₹30,000 monthly from his local shop three years ago. Today, he’s pulling in over ₹8 lakhs monthly by selling across multiple e-commerce platforms. His secret? Choosing the right platform mix that aligned with his products, budget, and growth ambitions.

If you’re among the millions of Indian entrepreneurs eyeing the digital goldmine, you’ve likely found yourself at this crossroads: Amazon vs Flipkart vs Meesho – which platform deserves your time, energy, and hard-earned money? The answer isn’t straightforward, and that’s exactly why over 2.3 million sellers are actively comparing these platforms every month.

Here’s the reality: India’s e-commerce market is exploding at 25% annual growth, projected to hit $350 billion by 2030. But here’s the catch – while the pie is growing, so is the competition. Every day, thousands of sellers are joining these platforms, making the right choice more crucial than ever. Choose wisely, and you could be the next success story. Choose poorly, and you might find yourself lost in a sea of competitors, burning through your savings with little to show for it.

Understanding the Indian E-commerce Ecosystem

India’s digital commerce revolution has been nothing short of remarkable. The country now boasts the world’s second-largest internet user base, with rapid smartphone adoption and increasing digital literacy driving unprecedented growth in online shopping behavior.

The rise of affordable internet connectivity through Jio’s disruption, coupled with government initiatives like Digital India, has democratized access to e-commerce platforms. This has created a perfect storm for both established and emerging sellers to tap into previously unreachable markets.

Rural markets, which were once considered difficult to penetrate, now represent some of the fastest-growing segments in Indian e-commerce. This shift has influenced how platforms design their seller programs and commission structures.

Amazon India: The Global Giant’s Local Strategy

Platform Overview and Market Position

Amazon entered the Indian market in 2013 and has since invested over $6.5 billion in building its infrastructure and ecosystem. The platform operates on a hybrid model, combining its own inventory with third-party sellers, creating a comprehensive marketplace that serves diverse customer needs.

With over 100 million registered users and presence in more than 15,000 pin codes, Amazon India has established itself as a formidable force in the country’s e-commerce landscape. The platform’s focus on customer-centricity has resulted in high customer loyalty and repeat purchase rates.

Indian E-commerce Market Share 2025

Flipkart

34%

Meesho

30%

Amazon

26%

Others

10%

🚀 Meesho’s explosive growth has made it the second-largest platform, challenging traditional leaders

Source: Multiple Industry Reports, 2024-2025

Seller Benefits and Opportunities

- Fulfillment by Amazon (FBA) Program – Amazon’s FBA service handles storage, packaging, shipping, and customer service for sellers, allowing them to focus on product sourcing and business growth. This service is particularly valuable for sellers who lack logistics infrastructure or want to scale quickly without operational headaches.

- Global Reach Potential – One of Amazon’s unique advantages is its Global Selling Program, which allows Indian sellers to reach international markets across Amazon’s global marketplace network. This opens doors to export opportunities that would otherwise be challenging for small and medium businesses.

- Advanced Analytics and Tools – Amazon provides sophisticated seller tools including detailed analytics, advertising platforms, and inventory management systems. These tools help sellers optimize their listings, understand customer behavior, and make data-driven decisions.

- Prime Customer Base Access – Sellers on Amazon gain access to Prime members, who typically spend more and shop more frequently than regular customers. This premium customer segment often translates to higher sales volumes and better profit margins.

Commission Structure and Costs

Amazon’s fee structure varies significantly across categories, ranging from 5% to 20% of the product’s selling price. Additional costs include:

- Fixed closing fees ranging from ₹4 to ₹60 per item

- FBA fees for storage and fulfillment

- Payment processing fees

- Advertising costs (optional but often necessary for visibility)

While these costs can seem substantial, many sellers find that Amazon’s customer base and conversion rates justify the investment.

Challenges and Limitations

- High Competition and Market Saturation – The sheer number of sellers on Amazon means intense competition, especially in popular categories. New sellers often struggle to gain visibility without significant advertising investment.

- Strict Performance Metrics – Amazon maintains rigid performance standards for sellers, including order defect rates, late shipment rates, and customer service metrics. Failure to meet these standards can result in account suspension.

- Complex Fee Structure – Understanding and managing Amazon’s various fees requires careful attention to detail and can be overwhelming for new sellers.

Flipkart: India’s Homegrown E-commerce Leader

Platform Overview and Market Position

Founded in 2007 by Sachin and Binny Bansal, Flipkart has grown to become India’s largest e-commerce platform by market share. The company’s deep understanding of Indian consumer behavior and local market nuances has been key to its success.

Flipkart serves over 350 million registered users and delivers to more than 27,000 pin codes across India. The platform’s focus on vernacular languages, local payment methods, and regional preferences has helped it capture significant market share in tier-2 and tier-3 cities.

Seller Benefits and Opportunities

- Strong Brand Recognition – Flipkart’s brand equity in India is unmatched, with high customer trust and loyalty. This translates to better conversion rates for sellers, as customers are more likely to purchase from a trusted platform.

- Flipkart Assured Program – Similar to Amazon’s Prime, Flipkart Assured provides sellers with access to quality-conscious customers who prefer verified, high-standard products. This program can significantly boost sales for qualifying sellers.

- Comprehensive Seller Support – Flipkart offers extensive seller support including account management, marketing assistance, and business growth consultation. The platform’s seller success team works closely with merchants to optimize their performance.

- Regional Market Penetration – Flipkart’s strong presence in smaller cities and rural areas provides sellers with access to emerging markets that are often underserved by competitors.

Commission Structure and Costs

Flipkart’s commission structure is generally competitive with Amazon, ranging from 2% to 20% depending on the category. The platform offers:

- Transparent fee structure with fewer hidden costs

- Competitive fulfillment charges through Flipkart Advantage

- Flexible payment cycles

- Various promotional tools and advertising options

Challenges and Limitations

- Limited International Reach – Unlike Amazon, Flipkart focuses primarily on the Indian market, which limits export opportunities for sellers looking to expand globally.

- Category Restrictions – Flipkart has stricter category requirements and approval processes for certain product segments, which can limit seller options.

- Technology Infrastructure Gaps – While improving, Flipkart’s seller tools and analytics are not as advanced as Amazon’s, which can impact data-driven decision making.

Meesho: The Social Commerce Revolution

Platform Overview and Market Position

Meesho represents a completely different approach to e-commerce, focusing on social selling and enabling individual entrepreneurs to start their businesses with minimal investment. Launched in 2015, Meesho has revolutionized how people think about online selling in India.

The platform serves as a bridge between suppliers and resellers, allowing individuals to sell products through social media channels like WhatsApp, Facebook, and Instagram. This model has proven particularly effective in reaching customers in smaller towns and rural areas.

Seller Benefits and Opportunities

- Zero Commission Model – Meesho’s biggest advantage is its zero-commission policy for sellers. This allows merchants to retain more profit from each sale, making it particularly attractive for price-sensitive products and small-scale sellers.

- Low Barrier to Entry – Unlike Amazon and Flipkart, Meesho requires minimal documentation and investment to start selling. This has democratized e-commerce for millions of Indians who previously couldn’t access traditional online selling platforms.

- Social Selling Integration – Meesho’s unique social commerce model allows sellers to leverage their personal networks and social media presence to drive sales. This creates more authentic customer relationships and higher trust levels.

- Comprehensive Seller Education – Meesho provides extensive training and support to help new sellers understand e-commerce basics, digital marketing, and business management.

Platform Commission Comparison

Commission Structure Across Categories

| Category | Amazon | Flipkart | Meesho |

|---|---|---|---|

| Electronics | 6-8% | 4-7% | 0% |

| Fashion | 11-17% | 9-15% | 0% |

| Home & Kitchen | 8-15% | 6-12% | 0% |

| Beauty & Health | 5-10% | 4-8% | 0% |

| Books | 13-15% | 10-20% | 0% |

*Additional fees like fulfillment, payment processing, and advertising charges apply separately

Commission Structure and Costs

Meesho’s fee structure is remarkably simple:

- Zero commission on sales

- Competitive shipping charges

- Optional advertising and promotion tools

- Transparent payment processing

Challenges and Limitations

- Limited Brand Recognition – Compared to Amazon and Flipkart, Meesho has lower brand recognition among certain customer segments, particularly urban, premium shoppers.

- Quality Control Concerns – The platform’s low barriers to entry sometimes result in quality control challenges, which can affect overall customer trust.

- Limited Advanced Features – Meesho’s seller tools and analytics are basic compared to more established platforms, which can limit growth for sellers who need sophisticated business intelligence.

Detailed Platform Comparison

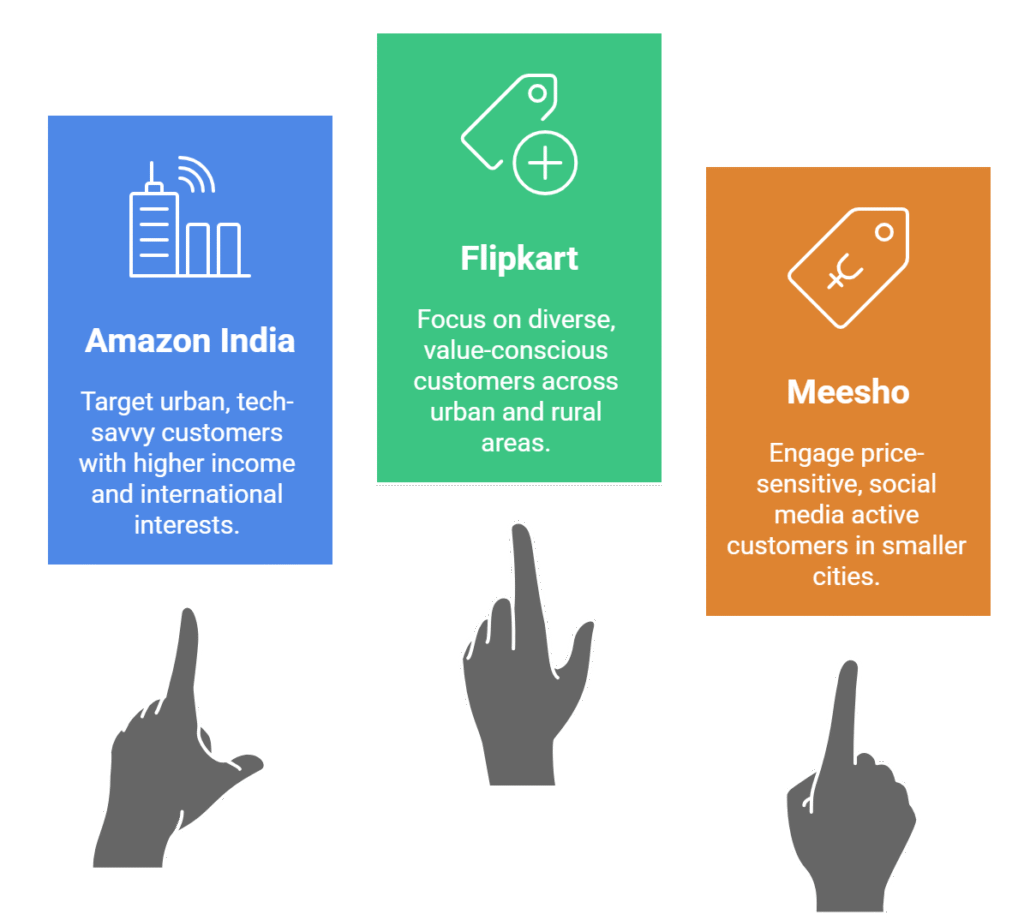

Target Customer Demographics

Amazon India

- Urban, educated customers with higher disposable income

- Tech-savvy shoppers who value convenience and premium service

- International product seekers

- Prime members who prioritize fast delivery

Flipkart

- Diverse customer base spanning urban and rural markets

- Value-conscious shoppers looking for deals and discounts

- Customers comfortable with vernacular languages

- Festival season heavy shoppers

Meesho

- Price-sensitive customers in tier-2 and tier-3 cities

- Social media active users

- First-time online shoppers

- Customers who prefer trusted recommendations

Category Performance Analysis

- Electronics and Gadgets – Amazon leads in premium electronics with strong customer trust for expensive purchases. Flipkart dominates in smartphones and consumer electronics through exclusive launches. Meesho focuses on accessories and affordable electronics.

- Fashion and Lifestyle – Flipkart’s fashion arm Myntra gives it an edge in branded fashion. Amazon performs well in international brands and premium fashion. Meesho excels in affordable, trendy fashion items and ethnic wear.

- Home and Kitchen – Amazon’s vast selection and FBA program make it strong in home improvement and premium kitchen appliances. Flipkart competes well in furniture and large appliances. Meesho focuses on decorative items and kitchen accessories.

Logistics and Fulfillment Comparison

Amazon’s Logistics Advantage

- Extensive fulfillment network with same-day and next-day delivery options

- Advanced inventory management and demand forecasting

- International shipping capabilities

- Higher logistics costs but superior service quality

Flipkart’s Ekart Network

- Strong last-mile delivery network, especially in rural areas

- Cost-effective fulfillment for domestic shipments

- Improving delivery speeds and service quality

- Good cash-on-delivery infrastructure

Meesho’s Simplified Approach

- Basic but effective logistics network

- Focus on cost optimization over speed

- Strong cash-on-delivery support

- Simplified return and refund processes

Marketing and Visibility Tools

Amazon’s Marketing Arsenal

- Sponsored Products, Brands, and Display advertising

- Amazon DSP for advanced targeting

- Brand Store creation capabilities

- External traffic support through Attribution tool

Flipkart’s Promotional Tools

- Product listing ads and keyword targeting

- Brand showcase opportunities

- Flipkart Ads Manager for campaign management

- Strong festival season promotion support

Meesho’s Social Commerce Focus

- Social media integration tools

- Catalog sharing features

- WhatsApp Business integration

- Community building support tools

Making the Right Choice: Decision Framework

For New Sellers

If you’re just starting your e-commerce journey, consider these factors:

Choose Amazon if:

- You have quality products with good margins

- You can invest in marketing and advertising

- You want access to premium customers

- Long-term brand building is your goal

Choose Flipkart if:

- You understand the Indian market well

- You have products suited for value-conscious customers

- You want strong festival season sales

- Regional market penetration is important

Choose Meesho if:

- You’re price-sensitive about platform costs

- You have a strong social media presence

- You’re targeting tier-2 and tier-3 markets

- You’re starting with limited capital

Platform Performance Metrics for Sellers

Average Seller Performance Indicators

Amazon

Avg Monthly Sales

Conversion Rate

Return Rate

Flipkart

Avg Monthly Sales

Conversion Rate

Return Rate

Meesho

Avg Monthly Sales

Conversion Rate

Return Rate

*Based on survey of 1000+ active sellers across platforms in 2024

For Experienced Sellers

If you’re already selling online and looking to expand:

Multi-platform Strategy Benefits

- Diversified risk across platforms

- Access to different customer segments

- Reduced dependency on single platform

- Better understanding of market dynamics

Resource Allocation Considerations

- Inventory management across platforms

- Customer service standardization

- Marketing budget distribution

- Performance tracking and optimization

For Specific Product Categories

- Fashion and Lifestyle Products – Meesho and Flipkart typically perform better due to their focus on trendy, affordable fashion. Amazon works well for premium and international fashion brands.

- Electronics and Gadgets – Amazon and Flipkart dominate this space with their sophisticated logistics and customer trust for high-value items.

- Home and Kitchen Items – All three platforms perform well, but success depends on product positioning and price points.

Success Stories and Case Studies

Small Business Transformation on Amazon

Rajesh Kumar from Jaipur started selling traditional Rajasthani handicrafts on Amazon in 2019. By leveraging FBA and Amazon’s global selling program, he scaled from ₹50,000 monthly sales to ₹15 lakhs, with 30% of sales coming from international markets.

Key success factors:

- Professional product photography

- Optimized product listings with relevant keywords

- Consistent inventory management

- Customer-focused approach

Flipkart Success in Regional Markets

Priya Sharma from Lucknow built a successful saree business on Flipkart, focusing on regional preferences and festival seasons. Her understanding of local customer behavior helped her achieve ₹25 lakhs in annual sales within two years.

Success strategies:

- Deep understanding of regional fashion preferences

- Strategic inventory planning for festivals

- Competitive pricing with good margins

- Strong customer service in local languages

Meesho’s Social Commerce Winner

Anil Verma from Patna started as a Meesho reseller and eventually became a successful supplier. His journey from earning ₹10,000 monthly to building a ₹5 lakh monthly business showcases Meesho’s potential for grassroots entrepreneurs.

Note:

Since 2024, Meesho has experienced unprecedented growth, capturing nearly 30% of India’s e-commerce market share and becoming the second-largest platform. This dramatic rise has created even more opportunities for sellers like Anil, with many achieving 6-figure monthly revenues through social commerce strategies.

Growth tactics:

- Building strong WhatsApp customer groups

- Consistent quality and service delivery

- Community engagement and trust building

- Gradual product range expansion

Future Trends and Platform Evolution

Technology Integration

- Artificial Intelligence and Machine Learning – All platforms are investing heavily in AI for better product recommendations, fraud detection, and inventory optimization. Sellers who understand and leverage these tools will have significant advantages.

- Voice Commerce and Regional Languages – The growth of voice-enabled shopping in regional languages presents new opportunities for sellers who can adapt their product listings and marketing strategies accordingly.

Market Expansion Strategies

- Meesho’s Meteoric Rise – The most significant trend of 2024-2025 has been Meesho’s explosive growth, jumping from a niche player to capturing 30% market share. This social commerce revolution is reshaping how Indians discover and purchase products, particularly in tier-2 and tier-3 cities. For sellers, this means the zero-commission model is not just sustainable but highly competitive.

- Rural Market Penetration – Continued focus on reaching smaller towns and villages will create new opportunities for sellers with products suited to these markets.

- International Expansion – Amazon’s global reach will continue to be a differentiator, while Flipkart and Meesho may explore international partnerships or expansion.

Sustainability and Social Commerce

- Environmental Considerations – Increasing focus on sustainable packaging and eco-friendly products will influence seller requirements and customer preferences.

- Social Impact Commerce – Platforms are likely to emphasize social impact and community building, particularly in rural and semi-urban markets.

Practical Tips for Platform Success

Optimizing Your Presence

Product Listing Optimization

- Use high-quality images with multiple angles

- Write compelling, keyword-rich product descriptions

- Include accurate specifications and dimensions

- Respond promptly to customer queries and reviews

Pricing Strategy

- Research competitor pricing regularly

- Factor in all platform fees when setting prices

- Use dynamic pricing tools where available

- Consider psychological pricing principles

Inventory Management

- Maintain optimal stock levels to avoid stockouts

- Plan for seasonal demand variations

- Use platform analytics to forecast demand

- Implement just-in-time inventory where possible

Building Customer Relationships

Customer Service Excellence

- Respond to inquiries within 24 hours

- Handle returns and refunds professionally

- Proactively communicate shipping updates

- Go above and beyond to resolve issues

Brand Building

- Maintain consistent brand messaging across platforms

- Develop unique value propositions

- Build email lists for direct marketing

- Leverage social proof through reviews and testimonials

Conclusion

The choice between Amazon vs Flipkart vs Meesho ultimately depends on your business goals, target customers, and available resources. Each platform offers unique advantages that can help Indian sellers succeed in the competitive e-commerce landscape.

Amazon provides access to premium customers and international markets but requires higher investment and faces intense competition. Flipkart offers strong brand recognition and regional market access with competitive fees and local market understanding. Meesho democratizes e-commerce with its zero-commission model and social commerce approach, making it ideal for new entrepreneurs and price-sensitive markets.

Rather than viewing this as an either-or decision, successful sellers increasingly adopt multi-platform strategies to diversify their revenue streams and reach different customer segments. Start with the platform that best aligns with your current capabilities and gradually expand to others as your business grows.

The Indian e-commerce market’s continued growth ensures opportunities for sellers who choose the right platform and execute their strategy effectively. Whether you choose Amazon, Flipkart, Meesho, or a combination of platforms, success will ultimately depend on your commitment to customer satisfaction, product quality, and continuous learning in this dynamic marketplace.